what is suta tax rate

1 2020 unemployment tax rates for experienced employers are to range from 0255 to 0849 for. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025.

Futa Tax Federal Unemployment Tax Act Definition Rate

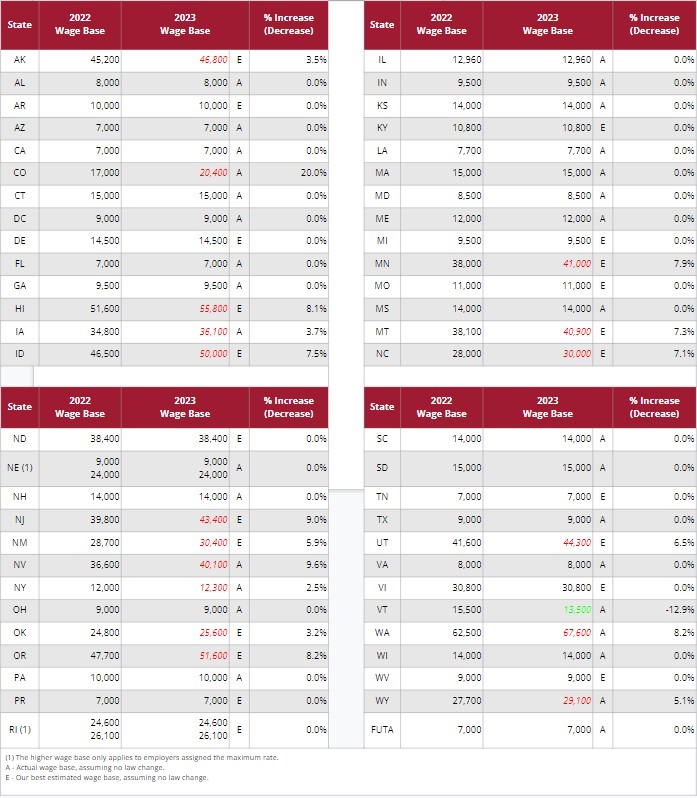

State taxes vary including the State Unemployment Tax Act SUTA contribution rates.

. You should be aware of current rates and understand how the tax is calculated. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. Usually your business receives a tax credit of up to.

It is a payroll tax that goes towards the state unemployment fund. Form W-4 or DE 4 on file with their employer. The yearly cost is.

Newly subject employers in the non-construction industry pay at a rate consistent with a positive account reserve percentage of between 105 but less than 11 from the rate schedule. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated. The best negative-rate class was assigned a rate of.

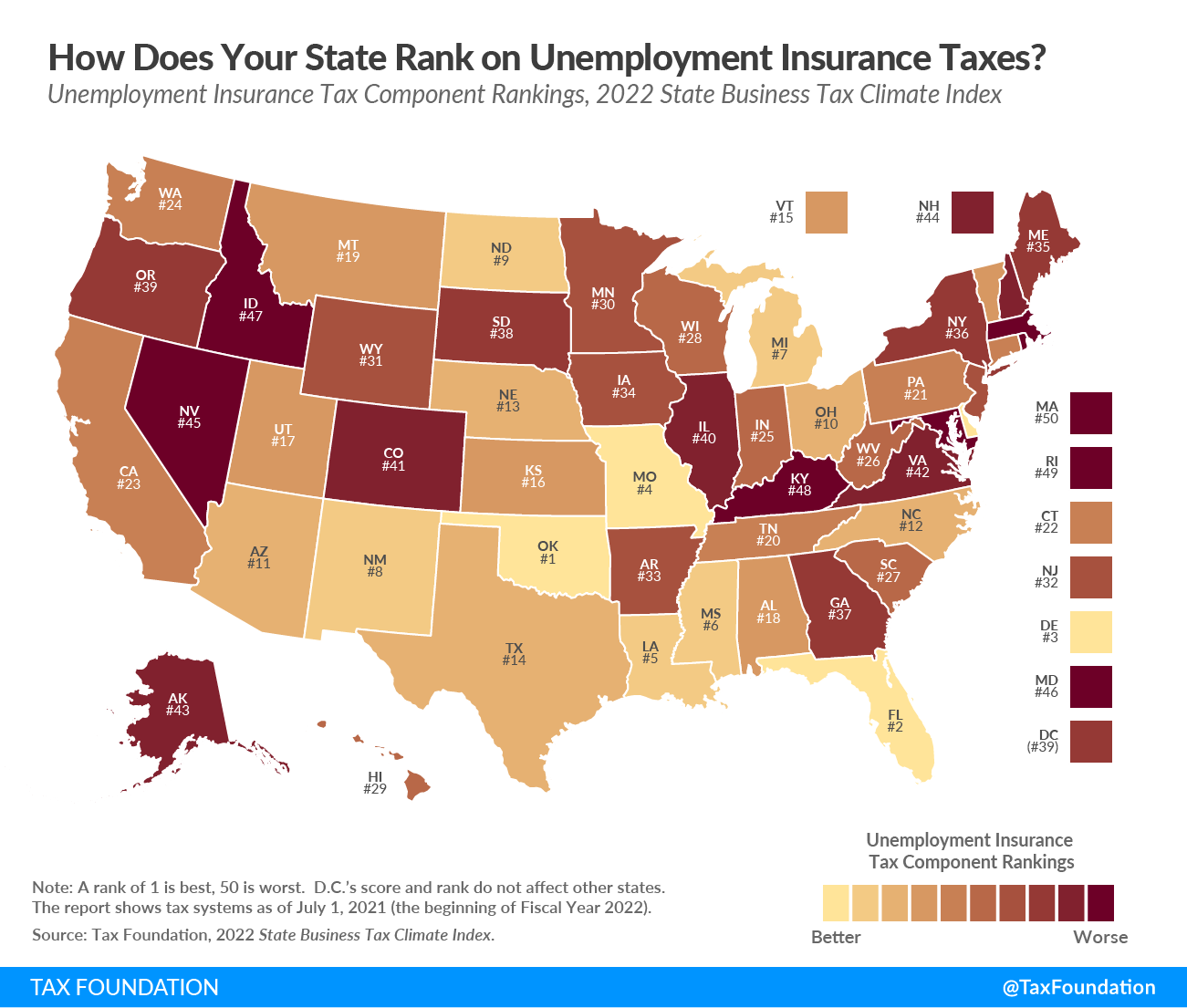

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. SUTA Tax Rates. SUTA rates by state as well as the taxable wage base differ from each other.

The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year. The states SUTA wage base is 7000 per. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee.

State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI. The tax rates vary from state to state and are updated periodically. The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. California has four state payroll taxes. 0010 10 or 700 per.

The maximum FUTA tax an employer must pay per employee per. Also asked what is the state unemployment tax rate for 2020. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee.

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. The 2022 wage base is 7700. A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year.

Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required. State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain a. Employers may make a voluntary.

Louisiana Unemployment Insurance Tax Rates. The unemployment tax rate is calculated by multiplying the individuals salary by the regular unemployment insurance tax rate. How Much Does An Employer.

Unemployment Insurance Taxes Tax Foundation

State Unemployment Insurance Tax Rates Tax Policy Center

Modernizing Employer Payroll Taxes Covering The True Costs Of Unemployment Benefits For Workers California Budget And Policy Center

Md Unemployment Tax Rates Have Increased For 2021 Bormel Grice Huyett P A

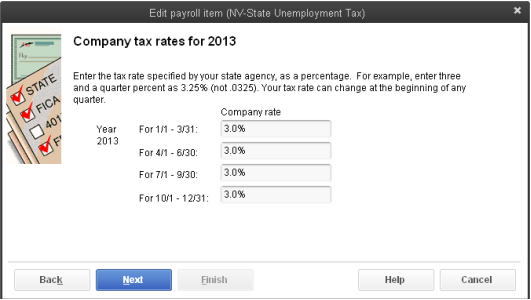

Change Sui Tax Rates For Basic Enhanced Standard Payroll

State Unemployment Insurance Sui Overview

Unemployment Tax Rates A Tutorial 501 C Agencies Trust

Suta Vs Futa What You Need To Know

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

2020 Pennsylvania Payroll Tax Rates Abacus Payroll

5 Ways To Lower Your Suta Tax Rate Paytime Payroll

View All Hr Employment Solutions Blogs Workforce Wise Blog

What Are Employer Taxes And Employee Taxes Gusto

Covid 19 Will Your Suta Tax Rate Go Up Workest

Understanding Unemployment Tax

Jason Jeffries Earned 10 200 While Working For Brown Company The Company S Suta Tax Rate Is 2 9 Of The First 7 000 Of Each Employee S Earnings Compute The Total Unemployment Taxes Suta And Futa

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube